The recent announcement of a $1.2B claim being submitted for alleged misrepresentation of utility risk on the Sydney Light Rail project will come as little surprise to anyone involved in the engineering construction industry and it highlights the issue of risk apportionment on large infrastructure projects.

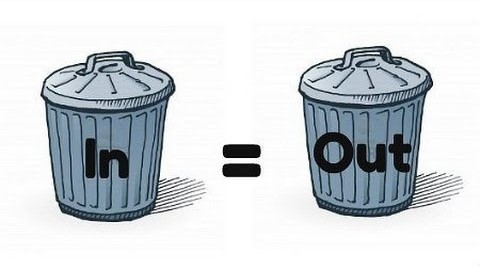

All too often, Clients seek to pass on liability for every conceivable construction risk to the contractor in the mistaken belief that this will provide greater certainty of (financial) outcome. Contractors, eager for work, price the risks even if they have no idea of risk magnitude, often using little more science than gut feeling. Some more sophisticated contractors will attempt to estimate the cost of the risks eventuating and enter the numbers into a Monte Carlo simulation to arrive at a probability adjusted risk contingency. However, when the resulting number is deemed too high the inputs are generally revised and the simulation run again to arrive at a more palatable number.

The end result is that contractors frequently under price risk and when the risk eventuates and project profitability is negatively impacted they look for ways to recover costs, usually by submitting contractual claims often with little regard to entitlement.

This is not a desirable outcome either for the contractor or the client as focus is diverted away from resolving issues on site to defending / advancing claims. It is doubtful, under such circumstances, that the Client is maximising project value regardless of claim outcome.

Principles of Risk Management

The general principle of risk management is that ownership of any given risk should lie with the party best able to manage that risk. In the case of utilities it is doubtful that this is the Contractor.

The issue of managing existing utilities is a particular problem on large infrastructure projects in brownfield locations, as typified by light rail projects in urban areas. Such projects are usually undertaken on behalf of government whether it be State, Federal or Council who either own utility organisations or at the very least are able to exert significant influence over them.

Whilst the contractor may be best placed to devise optimum solutions for clashes between new infrastructure and existing services, they come unstuck when dealing with the utility companies that have no incentive to work with the contractor to achieve best for project outcomes. In many cases the opposite is true and problems are viewed by utility companies as an opportunity to extract concessions / additional work from the contractor who has little option but to acquiesce.

What is the Solution?

If time allows, it could make sense to award an advance works contract specifically for relocating the known utilities that clash with the proposed new infrastructure. There are however two issues with this approach:

- Many services are un-mapped and only discovered when works the infrastructure works commence.

- The advance works can prolong disruption to local businesses and the community.

A better approach would be to jointly manage the risk and leverage the strengths of the various parties to address different aspects of the problem such as the contractor finding best for project solutions and the owner exerting influence on the utility companies to proactively engage with the contractor.

Simples?

Unfortunately, traditional forms of contract do not contemplate shared risk. Risk must be clearly allocated to one party or another.

Collaboration is the Key

That is why collaborative forms of contract, such as Integrated Project Delivery, should be considered for procuring complicated high-risk projects. Shared risk contingencies can be agreed with all parties incentivised to manage the risk to achieve best for project outcomes. The parties to the contract could even include the main utility providers themselves through engagement with them early in the procurement process.

By managing risk through a shared risk contingency, the owner also benefits by avoiding paying contractor’s mark up on contingency, particularly in respect of unspent contingency.

Such an approach can even be used for Public Private Partnerships (PPS) where the contractor generally contracts with a special purpose investment company as opposed to a government entity and need not be limited just to utility risk. It could also include other common but hard to estimate risks such as Latent Conditions and Weather.

BIM

Back to utilities and the principles of risk management again, longer term the answer to the problem lies in much improved mapping of utilities to remove or significantly lesson the risk. This can be achieved through city mapping projects and mandating the use of Building Information Modelling systems on projects to gradually build up an accurate 3D model of utilities and other infrastructure within urban environments

But that is the subject of another movie inspired blog….